The $1 Rule is a simple yet effective way to make smarter purchasing decisions. This budgeting strategy, based on the cost-per-use concept, helps you determine whether an item is worth the investment. By applying the $1 Rule, you can ensure that your money is well spent and that you get maximum value out of every purchase. In this blog post, we’ll explore the how, why, practical examples, and inspiring success stories of how the $1 Rule has transformed lives, helping individuals make wiser financial choices and achieve greater financial peace of mind.

Table of Contents

What is the $1 Rule?

If you’re trying to make smarter buying decisions and get the most value for your money, the $1 Rule is a fantastic guideline to follow. So, what is the $1 Rule? It’s a simple yet powerful concept based on the cost-per-use idea. Before making a purchase, you figure out how many times you’ll realistically use the item. If the cost per use breaks down to $1 or less, then it’s a good buy.

How Does the $1 Rule Work?

The $1 Rule is all about getting the best bang for your buck. Here’s how it works: Suppose you’re eyeing a new jacket that costs $100. Before you buy it, think about how many times you’ll actually wear it. If you can see yourself wearing the jacket at least 100 times, then the cost per use is $1 ($100/100 uses = $1 per use). In this case, the jacket is a worthwhile investment.

However, if you think you’ll only wear it 10 times, the cost per use jumps to $10, making it less of a good deal according to the $1 Rule.

Why Use the $1 Rule?

The $1 Rule helps you make more deliberate and mindful purchasing decisions. It encourages you to consider the true value of an item rather than just its price tag. This rule can help you:

- Avoid Impulse Buys: By taking a moment to calculate cost per use, you can deter yourself from buying things you won’t use often.

- Maximize Value: Ensuring that your purchases meet the $1 per use benchmark means you’re getting good value for every dollar spent.

- Reduce Clutter: Buying only items that you’ll use frequently helps keep your space tidy and uncluttered.

Practical Examples of the $1 Rule

Let’s look at some everyday examples:

- A $50 Pair of Jeans: If you wear them 50 times, that’s $1 per use. A solid buy.

- A $200 Blender: If you use it 200 times (e.g., making smoothies daily for most of the year), it’s a good investment.

- A $30 Movie Ticket: If it’s a one-time experience, that’s $30 per use, which doesn’t meet the $1 Rule unless the experience itself is considered priceless.

Applying the $1 Rule in Different Scenarios

Clothing and Accessories: Before splurging on a new wardrobe item, think about how often you’ll wear it. Basics like jeans and jackets usually fare well under the $1 Rule, while trendy pieces might not.

Gadgets and Appliances: High-ticket items like smartphones or kitchen appliances can be justified if you use them daily.

Entertainment and Experiences: Consider subscriptions and memberships. A $120 annual gym membership is a steal if you go at least 120 times a year.

Tips for Using the $1 Rule

- Be Honest with Yourself: Realistically assess how often you’ll use the item.

- Track Your Use: Keep a mental or physical note of how often you use big-ticket items to better inform future purchases.

- Consider Quality: Sometimes spending a bit more on a high-quality item means it’ll last longer and meet the $1 per use criterion.

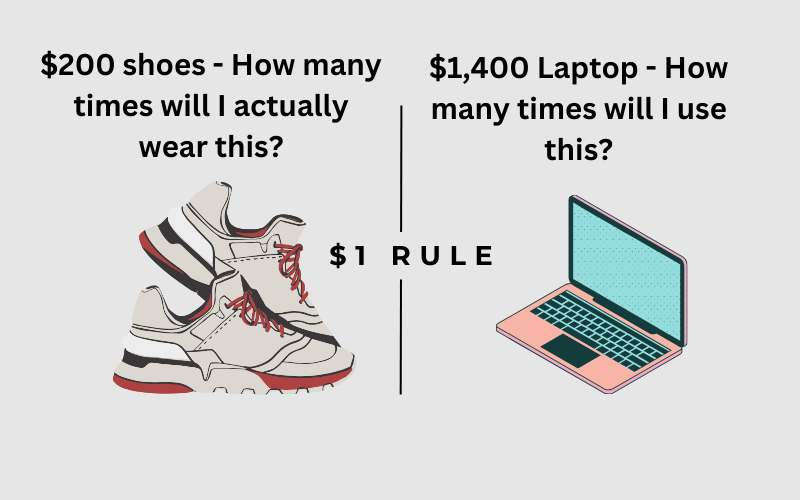

Visualizing the $1 Rule

Success Stories: How the $1 Rule Changed Lives

The $1 Rule isn’t just a clever budgeting trick—it’s a powerful tool that has transformed lives by promoting smarter spending habits and financial mindfulness. Let’s look at some real-life success stories that highlight how the $1 Rule has made a significant impact.

Sarah’s Story: Wardrobe Makeover

Sarah used to spend a lot on trendy clothes that she rarely wore. After learning about the $1 Rule, she decided to revamp her shopping habits. She now calculates the cost per use for each item before making a purchase. By focusing on quality over quantity, Sarah built a versatile wardrobe filled with pieces she loves and wears often. This not only saved her money but also reduced the clutter in her closet.

James’ Story: Smart Gadget Purchases

James was an early adopter of new tech gadgets, often buying the latest releases without considering their long-term value. After adopting the $1 Rule, he started evaluating the cost per use of each gadget. He now invests only in devices he knows he’ll use frequently. For example, his $300 tablet, used daily for work and entertainment, breaks down to well below $1 per use over a year. This approach helped James make more thoughtful purchases and get more value out of his investments.

Emma’s Story: Kitchen Essentials

Emma loves cooking and used to buy every kitchen gadget that caught her eye. However, many of these items ended up gathering dust. With the $1 Rule in mind, Emma started purchasing only the tools she knew she’d use regularly. Her $150 stand mixer, for instance, is used several times a week, making it a worthwhile investment. This rule has helped Emma create a functional and efficient kitchen, saving both money and space.

Tom’s Story: Fitness Journey

Tom was hesitant to invest in a pricey gym membership, fearing it might go unused. After applying the $1 Rule, he calculated that visiting the gym at least 100 times a year would make the $100 annual membership a great deal. Motivated by this, Tom committed to regular workouts. Not only did he get his money’s worth, but he also improved his health and fitness, making the $1 Rule a win-win for his wallet and well-being.

Lisa’s Story: Smart Spending on Kids’ Items

As a mother of two, Lisa found herself constantly buying toys, clothes, and gadgets for her children. Many of these items were quickly outgrown or lost interest. By implementing the $1 Rule, Lisa started assessing the value of each purchase.

She invested in a $200 playset, knowing her kids would use it daily. Over a year, the cost per use was well below $1, making it a great investment. This approach not only saved her money but also reduced clutter and encouraged her to buy durable, long-lasting items for her children.

Kate’s Story: Home Office Setup

Kate wanted to create a comfortable home office but was wary of overspending on furniture and equipment. Using the $1 Rule, she evaluated each potential purchase based on how often she’d use it. Her ergonomic chair, which cost $200, is used every day for work, making it a smart investment. This approach helped Kate create a productive workspace without breaking the bank.

Conclusion: Real-Life Benefits of the $1 Rule

These success stories show how the $1 Rule can guide you toward making more intentional and beneficial purchases. Whether it’s clothing, gadgets, kitchen tools, fitness memberships, kid’s items, or home office setup the $1 Rule ensures you get maximum value for your money. By adopting this simple yet effective rule, you too can transform your spending habits and achieve financial peace of mind.

Let me know in the comments below and share your success stories of the $1 Rule. If you would like further reading or book recommendations, below are highly recommended books:

Books on Achieving Financial Freedom

- “Rich Dad Poor Dad” by Robert T. Kiyosaki

- Focuses on the importance of financial education, investing in assets, and building passive income streams.

- “The Millionaire Fastlane” by MJ DeMarco

- Advocates for entrepreneurial ventures as a faster path to wealth compared to traditional jobs and investments.

- “Your Money or Your Life” by Vicki Robin and Joe Dominguez

- Offers a program for transforming your relationship with money and achieving financial independence through mindful spending and investing.

- “The Simple Path to Wealth” by JL Collins

- Emphasizes the power of index investing and simple strategies for growing wealth.

- “Financial Freedom: A Proven Path to All the Money You Will Ever Need” by Grant Sabatier

- Shares practical steps and strategies for reaching financial independence quickly, based on the author’s personal journey.

Pingback: Effortless Style: Key Tips for a Timeless and Comfortable Wardrobe - Cindy Umeki